What is a Dynasty Trust?

A dynasty trust is an irrevocable trust that contains “dynasty” provisions that instruct the trustee to hold the assets placed in the trust for more than one generation. The duration or life of the trust depends on the laws of the state under which it is governed, commonly referred to as the “rule against perpetuities.”

If the assets transferred to the trust are exempt from Generation-Skipping Transfer tax (GST tax), then they may benefit future generations without further estate or transfer taxes.

Dynasty provisions can be included in any trust:

- Revocable trusts

- Irrevocable life insurance trusts (ILITs)

- Asset protection trusts

- Credit-Shelter trusts

- Trusts established by a will (Testamentary trusts)

What are the Benefits of a Dynasty Trust?

The benefits of holding assets in trust for high net worth clients is obvious: trust assets grow and compound within the trust fee of estate taxes that would normally be levied at the death of each generation. This is how family wealth has been created, for example, the Rockefellers, Carnegies, etc.

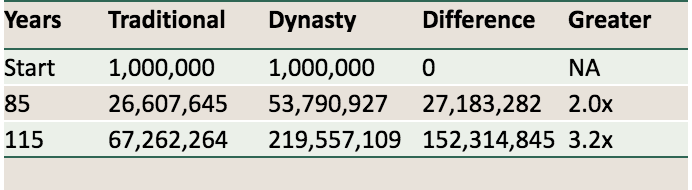

Under reasonable growth and income tax assumptions, $1 million left in a typical one-generation trust for 115 years (within the time periods permitted in most states) would grow to about $67 million. The same $1 million in a Dynasty Trust would grow to almost$220 million, about 3.2 times more due to compounding growth and estate tax savings. There are several states that permit perpetual trusts, and in Nevada, a dynasty trust can last 365 years. Compounding effects longer than 115 years are more staggerings.

Who Can Apply for a Dynasty Trust?

Dynasty trusts are not only for the wealthy. As is common with irrevocable trusts that have been established by someone other than the beneficiary, the assets held in the trust are exempt from creditor claims of the beneficiary. That includes divorcing spouses. Today, more than half of marriages end in divorce.

By incorporating “dynasty” provisions into their planning vehicles, clients of even modest wealth can protect their children, grandchildren, great-grandchildren and further from the loss of assets.